Gold is one of the most desired commodities worldwide. It continues to be a well-liked investment option for many individuals and has long been a representation of wealth and prosperity. Owning gold does, however, carry some risks. This is where gold insurance comes in.

In this article, we will discuss everything you need to know about this specialized policy. So, without further ado, let's dive in.

What is Gold Insurance?

A type of indemnity policy known as "gold insurance" protects owners of precious metals from financial losses caused by theft, loss, or damage to their possessions. It is a kind of home indemnity created especially to cover the dangers connected with gold ownership. Most significant indemnity providers offer gold indemnity, which is frequently bundled with many other different types of coverage.

Why Do You Need Gold Insurance?

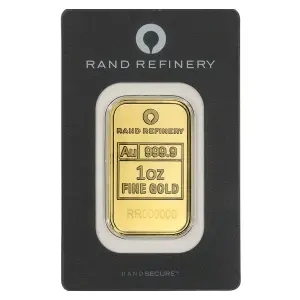

Gold indemnity is essential if you hold gold in any form, including bars, coins, or jewelry. Thieves frequently target gold since it is a valuable asset, and as the cost of gold rises, so does the chance of theft. Furthermore, gold is readily lost or damaged, which could lead to significant financial losses. If you get access to gold indemnity, you will be secured against such dangers.

What Is Covered by Gold Insurance?

Theft is the first danger that's covered by gold insurance. This refers to the taking of gold from your house, place of business, or any other place where your gold is kept. The policy may also cover theft that occurs during transportation.

Another risk that is covered is loss. This includes any damages to your gold that result from mishaps, natural disasters, or other unforeseen circumstances. For instance, you will be covered for the loss if your gold is lost in a fire, earthquake, or flood.

Furthermore, your insurance plan can cover any damages to your gold. This includes harm brought on by fire, water, or any other types of unintentional acts. For instance, your indemnity coverage will pay to repair or replace any gold jewelry that is harmed in a fire.

What Does Gold Insurance Not Cover?

It is important to understand what your gold indemnity policy does not cover. Typically, insuring your gold does not cover losses that occur due to normal wear and tear, depreciation, or fluctuations in the value of gold.

How Does Gold Insurance Work?

For people who possess gold, purchasing gold insurance is a wise investment because it provides a defense against dangers, including theft, loss, and damage. Here is a thorough description of how gold indemnity functions:

You engage in a contract with an indemnity provider when you buy a gold insurance plan. The coverage's terms and conditions, such as the coverage limit, premium cost, benefits, and deductions, are described in the policy.

You must provide the insurance company with a precise estimate of the worth of your gold in order to be covered. The amount of coverage you need and the value of your gold are often taken into account when determining the price you must pay out of pocket.

When you submit a claim to the indemnity provider, you must provide supporting evidence, including a police report or assessment. The indemnity provider will next assess your claim to see if it qualifies for coverage under the terms of your policy.

If your claim is granted, you will be eligible to be compensated up to the policy-specified coverage level. The lost or damaged gold may be replaced, or the compensation may take the shape of a cash payment.

In order to maintain being covered, it's crucial to keep your gold insurance plan active by paying the monthly premium. You won't be shielded from any foreseeable hazards to your gold investment if your it expires.

How To Qualify For Gold Insurance?

You normally need to fulfill certain standards established by the government or the indemnity provider in order to be eligible to insure your gold. The insurer may have different requirements, however, the following variables are frequently taken into account when determining your eligibility for gold indemnity:

- You must hold gold or other types of precious metals that you want to insure in order to be eligible for gold indemnity.

- Your ability to obtain indemnity may be impacted by the value of your gold holdings. If you want to insure your gold, several insurers may have minimum or maximum value limitations.

- Your eligibility may be impacted by the type of gold you own. For example, some insurers might not cover specific forms of gold, including rare or old coins.

- The place where you keep your gold can affect whether you qualify for insurance or not. In order to access indemnity, some insurers may insist that your gold be kept in a safe or bank vault.

- You could be required to supply personal information, such as your age, place of employment, and credit score, in order to acquire gold indemnity. The insurer can use this data to assess your risk profile and establish your premiums.

How to Choose the Right Gold Insurance Policy?

For the sake of safeguarding your investment in precious metals, selecting the appropriate gold insurance policy is essential. Here are some things to take into account while choosing a policy:

Coverage

The first factor to take into account is the kind of coverage that the policy offers. Risks like theft, loss, or damage may be covered differently by different insurance plans. Verify if the policy includes the hazards about which you are most worried. If you intend to store your gold in a safe deposit box, for instance, be sure the indemnity covers transportation-related losses.

Premium

The amount of money you pay determines how much indemnity coverage you receive. Think about the premium amount you pay and how it works with your spending plan.

Deductible

The deductible is the sum of money you are required to fork over before your indemnity provider begins to insure any losses. The deductible amount and your financial capacity should be taken into account. High deductibles may lead to lower premiums, but it also means that you will have to pay out of pocket more in the event of a loss.

Coverage Limit

The coverage limit, or "cap," is the highest sum that an indemnity provider would reimburse for a claim. Check to see if the limit is sufficient to insure the cost of your gold. It's possible that you won't get paid out in full for your losses if the limit is too low.

The reputation of the Insurance Company

Working with a respected indemnity provider is very important. Be sure to choose a business that has a solid financial standing and a track record of offering first-rate customer service. In order to select a trustworthy insurance provider, read online reviews and request recommendations from other gold owners.

Final Words

In conclusion, insuring your gold is a crucial investment for gold and silver owners who want to protect themselves from potential hazards including theft, loss, and damage. It's important to take into account aspects like coverage limits, rates, and deductibles when choosing a gold indemnity policy.

Gold insurance policies typically offer lower premiums to policyholders who are willing to pay out-of-pocket costs for higher deductibles. By agreeing to a higher deductible, you can lower your monthly premium, making gold indemnity more affordable if you want to shield your investment but may not have a lot of disposable income.

Knowing that your investment is protected by insuring your gold gives you peace of mind. Lastly, in order to maintain coverage, it's important to keep your indemnity active by paying the set amount of money.